无论你是投资老手还是刚开始学习投资的小白

你都会留意到网路上人们都在讨论投资策略,捞底,还是不管市场高低定期定额投资等

“投资者” 会教你要长期持有,如果资金不大就定期定额投资

“投机者” 会教你要根据市场的趋势,情绪来交易,以”趋势是你的朋友”的理念来投资

其实双方的论点都听起来行得通,这里我们只相信数据

数据怎么说呢?到底哪个策略最赚钱?

数据读取

我从Yahoo Finance上下载了各大指数的历史数据,

要分析数据得先读取这个csv文件。

import pandas as pd

import datetime

import matplotlib.pyplot as plt

pd.options.mode.chained_assignment = None # default='warn'

plt.style.use('seaborn')

period_type = 'M'

def read_and_process_data(name):

df = pd.read_csv(name,parse_dates=['Date'])

df = df.replace(',','', regex=True)

df['Open'] = df['Open'].astype(float)

df['Close'] = df['Close'].astype(float)

data = df.resample(period_type, on = 'Date').last()

data = data[data['Date'] > '01-01-2011']

data['Open'] = data['Open'].resample(period_type).first()

data['High'] = data['High'].resample(period_type).max()

data['Low'] = data['Low'].resample(period_type).min()

data['Close'] = data['Close'].resample(period_type).last()

data['Change'] = ((data['Close'].shift(-1) - data['Close'])/data['Close']) + 1

data['All_Time_High'] = data['Close'].cummax()

data['Previous_Peak'] = data['Close'].rolling(24, min_periods = 1).max()

data['Previous_Peak'] = data['Previous_Peak'].ffill()

data['Changes_From_Previous_Peak'] = (data['Previous_Peak'] - data['Close'])/data['Previous_Peak']

data.dropna(axis=1, how='all', inplace = True)

data = data.fillna(1)

return data

data = read_and_process_data('MSGX.csv')

data.head()| Date | Open | High | Low | Close | Adj Close | Change | All_Time_High | Previous_Peak | Changes_From_Previous_Peak | |

|---|---|---|---|---|---|---|---|---|---|---|

| Date | ||||||||||

| 2011-01-31 | 2011-01-31 | 3190.04 | 3280.77 | 3177.78 | 3179.72 | 3179.72 | 0.946785 | 3179.72 | 3179.72 | 0.000000 |

| 2011-02-28 | 2011-02-28 | 3179.72 | 3232.99 | 2965.24 | 3010.51 | 3010.51 | 1.031669 | 3179.72 | 3179.72 | 0.053215 |

| 2011-03-31 | 2011-03-31 | 3010.51 | 3115.47 | 2919.98 | 3105.85 | 3105.85 | 1.021534 | 3179.72 | 3179.72 | 0.023232 |

| 2011-04-30 | 2011-04-30 | 3105.85 | 3208.34 | 3103.22 | 3172.73 | 3172.73 | 0.995966 | 3179.72 | 3179.72 | 0.002198 |

| 2011-05-31 | 2011-05-31 | 3179.86 | 3182.46 | 3078.26 | 3159.93 | 3159.93 | 0.987503 | 3179.72 | 3179.72 | 0.006224 |

策略

这次我们回测的有4个策略

- 每月买入相同的数额

- 每个存下相同的数额,在市场从24个月高点跌了20%才买入

- 一次性投入,买入并持有

- 一次性投入,买入并持有,市场破历史新高时卖出,在市场从24个月高点跌了20%才买入

每个策略投入的总金额都是一样的

initial_capital = 100

monthly_topup = 100

lumpsum = initial_capital + len(data)*monthly_topup

data['Capital_DCA'] = 0 # Buy fixed amount every month

data['Capital_buythedip'] = 0 # Save up fixed amount every month, only buy when there is 20% dip from previous peak

data['Capital_lumpsum'] = 0 # Buy and hold from beginning

data['Capital_lumpsum_tactical'] = 0 # Buy and hold from beginning, sell when price breaks all time high, buy when 20% dip

data['Capital'] = 0

data['Cash'] = 0

for i in range(0,len(data)):

if i == 0:

data['Capital_buythedip'][i] = data['Change'][i] * initial_capital

else:

if data['Changes_From_Previous_Peak'][i-1] > 0.2:

data['Capital_buythedip'][i] = (data['Change'][i])*(data['Capital_buythedip'][i-1]+

monthly_topup + data['Cash'][i-1])

data['Cash'][i] = 0

else:

data['Capital_buythedip'][i] = ((data['Change'][i])*data['Capital_buythedip'][i-1]) + monthly_topup/2

data['Cash'][i] = data['Cash'][i-1] + monthly_topup/2

if data['Close'][i] >= data['All_Time_High'][i]:

temp = data['Cash'][i]

data['Cash'][i] = data['Capital_buythedip'][i] + temp

data['Capital_buythedip'][i] = 0

data['Capital_buythedip'] = data['Capital_buythedip'] + data['Cash']

for i in range(0,len(data)):

if i == 0:

data['Capital_DCA'][i] = data['Change'][i] * initial_capital

data['Capital_lumpsum'][i] = data['Change'][i] * lumpsum

data['Capital'][i] = data['Change'][i] * initial_capital

else:

data['Capital_DCA'][i] = ((data['Change'][i])*data['Capital_DCA'][i-1]) + monthly_topup

data['Capital_lumpsum'][i] = data['Change'][i]*data['Capital_lumpsum'][i-1]

data['Capital'][i] = data['Capital'][i-1] + monthly_topup

data['Cash'] = 0

for i in range(0,len(data)):

if i == 0:

data['Capital_lumpsum_tactical'][i] = data['Change'][i] * lumpsum

else:

if data['Changes_From_Previous_Peak'][i-1] > 0.2:

data['Capital_lumpsum_tactical'][i] = (data['Change'][i])*(data['Capital_lumpsum_tactical'][i-1] \

+ data['Cash'][i-1])

data['Cash'][i] = 0

else:

data['Capital_lumpsum_tactical'][i] = ((data['Change'][i])*data['Capital_lumpsum_tactical'][i-1])

data['Cash'][i] = data['Cash'][i-1]

if data['Close'][i] >= data['All_Time_High'][i]:

temp = data['Cash'][i]

data['Cash'][i] = data['Capital_lumpsum_tactical'][i] + temp

data['Capital_lumpsum_tactical'][i] = 0

data['Capital_lumpsum_tactical'] = data['Capital_lumpsum_tactical'] + data['Cash']

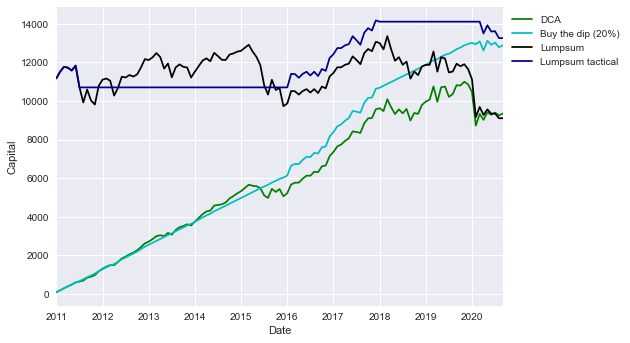

ax = data['Capital_DCA'].plot(color = 'g')

data['Capital_buythedip'].plot(ax = ax, color = 'c')

data['Capital_lumpsum'].plot(ax = ax, color = 'k')

data['Capital_lumpsum_tactical'].plot(ax = ax, color = 'darkblue')

ax.set_ylabel('Capital')

plt.legend(['DCA', 'Buy the dip (20%)', 'Lumpsum', 'Lumpsum tactical'], bbox_to_anchor=(1, 1))

plt.show()

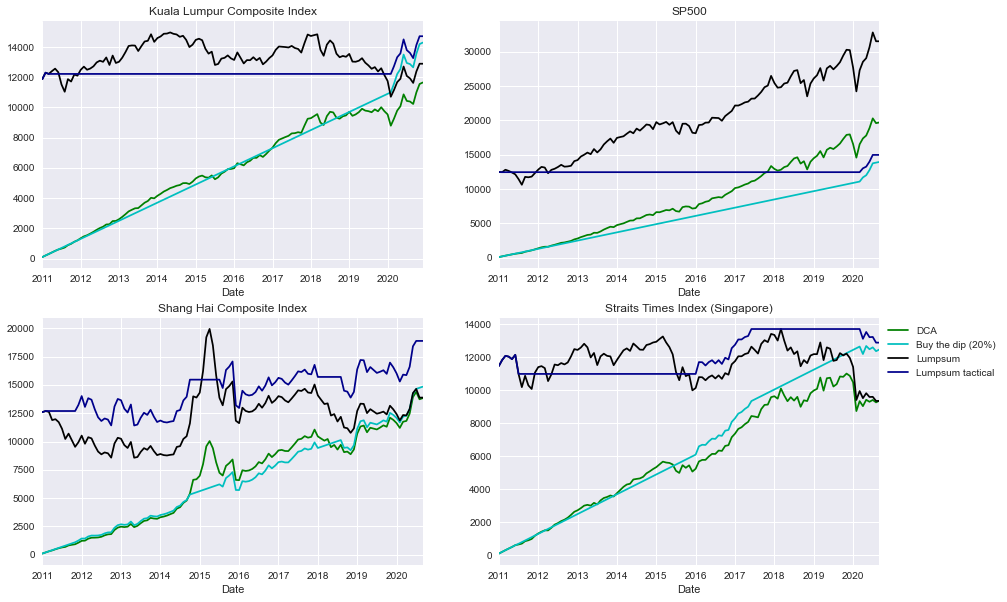

再回测

回测结果看起来不错,先试试别的市场数据

def backtest_monthly_buythedip(data, initial_capital, monthly_topup):

data['Capital'] = 0

data['Cash'] = 0

for i in range(0,len(data)):

if i == 0:

data['Capital'][i] = data['Change'][i] * initial_capital

else:

if data['Changes_From_Previous_Peak'][i-1] > 0.2:

data['Capital'][i] = (data['Change'][i])*(data['Capital'][i-1]+ monthly_topup + data['Cash'][i-1])

data['Cash'][i] = 0

else:

data['Capital'][i] = ((data['Change'][i])*data['Capital'][i-1])

data['Cash'][i] = data['Cash'][i-1] + monthly_topup

if data['Close'][i] >= data['Previous_Peak'][i]:

temp = data['Cash'][i]

data['Cash'][i] = data['Capital'][i] + temp

data['Capital'][i] = 0

# sell if close >= previous_peak

data['Capital'] = data['Capital'] + data['Cash']

return data['Capital']

def backtest_lumpsum(data, lumpsum):

data['Capital'] = 0

data['Cash'] = 0

for i in range(0,len(data)):

if i == 0:

data['Capital'][i] = data['Change'][i] * lumpsum

else:

data['Capital'][i] = data['Change'][i]*data['Capital'][i-1]

return data['Capital']

def backtest_DCA(data, initial_capital, monthly_topup):

data['Capital'] = 0

data['Cash'] = 0

for i in range(0,len(data)):

if i == 0:

data['Capital'][i] = data['Change'][i] * initial_capital

else:

data['Capital'][i] = ((data['Change'][i])*data['Capital'][i-1]) + monthly_topup

return data['Capital']

def backtest_lumpsum_tactical(data, lumpsum):

data['Capital'] = 0

data['Cash'] = 0

for i in range(0,len(data)):

if i == 0:

data['Capital'][i] = data['Change'][i] * lumpsum

else:

if data['Changes_From_Previous_Peak'][i-1] > 0.2:

data['Capital'][i] = (data['Change'][i])*(data['Capital'][i-1] \

+ data['Cash'][i-1])

data['Cash'][i] = 0

else:

data['Capital'][i] = ((data['Change'][i])*data['Capital'][i-1])

data['Cash'][i] = data['Cash'][i-1]

if data['Close'][i] >= data['Previous_Peak'][i]:

temp = data['Cash'][i]

data['Cash'][i] = data['Capital'][i] + temp

data['Capital'][i] = 0

data['Capital'] = data['Capital'] + data['Cash']

return data['Capital']KLSE = read_and_process_data('KLSE.csv')

SP500 = read_and_process_data('MSP500.csv')

CHN = read_and_process_data('MShangHai.csv')

SGX = read_and_process_data('MSGX.csv')

initial_capital = 100

monthly_topup = 100

lumpsum = initial_capital + (len(KLSE)*monthly_topup)

KLSE_DCA = backtest_DCA(KLSE.copy(), initial_capital, monthly_topup)

KLSE_20pct = backtest_monthly_buythedip(KLSE.copy(), initial_capital, monthly_topup)

KLSE_lumpsum = backtest_lumpsum(KLSE.copy(), lumpsum)

KLSE_lumpsum_tactical = backtest_lumpsum_tactical(KLSE.copy(), lumpsum)

SP500_DCA = backtest_DCA(SP500.copy(), initial_capital, monthly_topup)

SP500_20pct = backtest_monthly_buythedip(SP500.copy(), initial_capital, monthly_topup)

SP500_lumpsum = backtest_lumpsum(SP500.copy(), lumpsum)

SP500_lumpsum_tactical = backtest_lumpsum_tactical(SP500.copy(), lumpsum)

CHN_DCA = backtest_DCA(CHN.copy(), initial_capital, monthly_topup)

CHN_20pct = backtest_monthly_buythedip(CHN.copy(), initial_capital, monthly_topup)

CHN_lumpsum = backtest_lumpsum(CHN.copy(), lumpsum)

CHN_lumpsum_tactical = backtest_lumpsum_tactical(CHN.copy(), lumpsum)

SGX_DCA = backtest_DCA(SGX.copy(), initial_capital, monthly_topup)

SGX_20pct = backtest_monthly_buythedip(SGX.copy(), initial_capital, monthly_topup)

SGX_lumpsum = backtest_lumpsum(SGX.copy(), lumpsum)

SGX_lumpsum_tactical = backtest_lumpsum_tactical(SGX.copy(), lumpsum)

fig, axes = plt.subplots(nrows=2, ncols=2, figsize=(15,10))

KLSE_DCA.plot(ax = axes[0,0], color = 'g')

KLSE_20pct.plot(ax = axes[0,0], color = 'c')

KLSE_lumpsum.plot(ax = axes[0,0], color = 'k')

KLSE_lumpsum_tactical.plot(ax = axes[0,0], color = 'darkblue')

axes[0,0].set_title("Kuala Lumpur Composite Index")

SP500_DCA.plot(ax = axes[0,1], color = 'g')

SP500_20pct.plot(ax = axes[0,1], color = 'c')

SP500_lumpsum.plot(ax = axes[0,1], color = 'k')

SP500_lumpsum_tactical.plot(ax = axes[0,1], color = 'darkblue')

axes[0,1].set_title("SP500")

CHN_DCA.plot(ax = axes[1,0], color = 'g')

CHN_20pct.plot(ax = axes[1,0], color = 'c')

CHN_lumpsum.plot(ax = axes[1,0], color = 'k')

CHN_lumpsum_tactical.plot(ax = axes[1,0], color = 'darkblue')

axes[1,0].set_title("Shang Hai Composite Index")

SGX_DCA.plot(ax = axes[1,1], color = 'g')

SGX_20pct.plot(ax = axes[1,1], color = 'c')

SGX_lumpsum.plot(ax = axes[1,1], color = 'k')

SGX_lumpsum_tactical.plot(ax = axes[1,1], color = 'darkblue')

axes[1,1].set_title("Straits Times Index (Singapore)")

plt.legend(['DCA', 'Buy the dip (20%)', 'Lumpsum', 'Lumpsum tactical'], bbox_to_anchor=(1, 1))

plt.show()

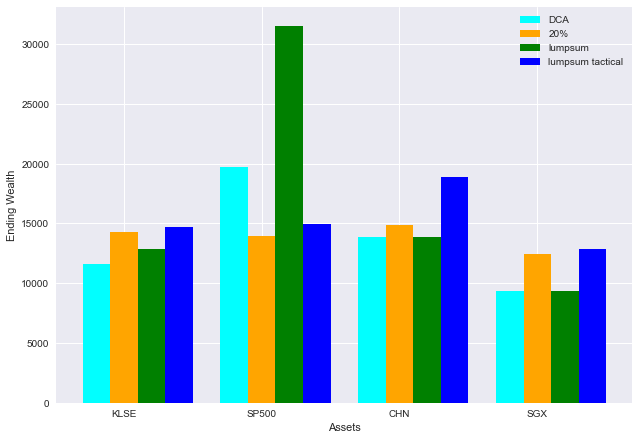

fig = plt.figure()

ax = fig.add_axes([0,0,1,1])

import numpy as np

x = np.arange(4)

DCA = [KLSE_DCA[-1], SP500_DCA[-1], CHN_DCA[-1], SGX_DCA[-1]]

PCT20 = [KLSE_20pct[-1], SP500_20pct[-1], CHN_20pct[-1], SGX_20pct[-1]]

lumpsum = [KLSE_lumpsum[-1], SP500_lumpsum[-1], CHN_lumpsum[-1], SGX_lumpsum[-1]]

lumpsum_tactical = [KLSE_lumpsum_tactical[-1], SP500_lumpsum_tactical[-1],

CHN_lumpsum_tactical[-1], SGX_lumpsum_tactical[-1]]

width = 0.2

# plot data in grouped manner of bar type

plt.bar(x-0.2, DCA, width, color='cyan')

plt.bar(x, PCT20, width, color='orange')

plt.bar(x+0.2, lumpsum, width, color='green')

plt.bar(x+0.4, lumpsum_tactical, width, color='blue')

plt.xticks(x, ['KLSE', 'SP500', 'CHN', 'SGX'])

plt.xlabel("Assets")

plt.ylabel("Ending Wealth")

plt.legend(['DCA', '20%', 'lumpsum', 'lumpsum tactical'])

plt.show()

结论

- 没有一个策略可以总是跑赢其他策略,策略的有效性得看市场的”性格”

- 一次性投入, 在超长牛市是最好的策略

- 投机或捞底, 在高波动的市场的最好的策略

- 要是你总是在等捞底,你可能错过牛市

- 一次性投入需要大量资金,每月定期定额的策略对普通人比较适合