介绍

这里就不多加介绍蜡烛图的构造和历史了, 有兴趣的朋友可以上网搜索有关资讯, 而且有关资讯也相当丰富, 也不用我来介绍了.

研究方法

小编用了Python编程程序来回测各个蜡烛图形在过去10年马股每一个个股的表现.

初始化

我们需要pandas来处理庞大的数据和talib内建的蜡烛图标识功能.之后, 我们初始化一个我们想要测试的蜡烛图案的list.

import pandas as pd

import talib

import os

pd.set_option('expand_frame_repr', False)

pattern_name = ['CDL2CROWS','CDL3BLACKCROWS','CDL3INSIDE','CDL3LINESTRIKE','CDL3OUTSIDE',

'CDL3STARSINSOUTH','CDL3WHITESOLDIERS','CDLABANDONEDBABY','CDLADVANCEBLOCK',

'CDLBELTHOLD','CDLBREAKAWAY','CDLCLOSINGMARUBOZU','CDLCONCEALBABYSWALL',

'CDLCOUNTERATTACK','CDLDARKCLOUDCOVER','CDLDOJI','CDLDOJISTAR',

'CDLDRAGONFLYDOJI','CDLENGULFING','CDLEVENINGDOJISTAR','CDLEVENINGSTAR',

'CDLGAPSIDESIDEWHITE','CDLGRAVESTONEDOJI','CDLHAMMER','CDLHANGINGMAN',

'CDLHARAMI','CDLHARAMICROSS','CDLHIGHWAVE','CDLHIKKAKE','CDLHIKKAKEMOD',

'CDLHOMINGPIGEON','CDLIDENTICAL3CROWS','CDLINNECK','CDLINVERTEDHAMMER','CDLKICKING',

'CDLKICKING','CDLKICKINGBYLENGTH','CDLLADDERBOTTOM','CDLLONGLEGGEDDOJI',

'CDLLONGLINE','CDLMARUBOZU','CDLMATCHINGLOW','CDLMATHOLD','CDLMORNINGDOJISTAR',

'CDLMORNINGSTAR','CDLONNECK','CDLPIERCING','CDLRICKSHAWMAN','CDLRISEFALL3METHODS'

'CDLSEPARATINGLINES','CDLSHOOTINGSTAR','CDLSHORTLINE','CDLSPINNINGTOP',

'CDLSTALLEDPATTERN','CDLSTICKSANDWICH','CDLTAKURI','CDLTASUKIGAP','CDLTHRUSTING',

'CDLTRISTAR','CDLUNIQUE3RIVER','CDLUPSIDEGAP2CROWS','CDLXSIDEGAP3METHODS']读取股市数据

通常使用蜡烛图的都是短期交易者, 所以我测试的天数也较短.

days = [1,5,10,30]

path = os.getcwd()

print('current working directory:',path)

stock_code_list = []

for root, dirs, files in os.walk(path):

if files:

for f in files:

if '.csv' in f:

stock_code_list.append(f.split('.csv')[0])开始分析

代码写好后就开始让它工作吧!

output = pd.DataFrame()

final_output = pd.DataFrame(columns=['Pattern', 'Win Rate (1 Day)', 'Win Rate (5 Days)','Win Rate (10 Days)',

'Win Rate (30 Days)'])

for pattern in pattern_name:

for code in stock_code_list:

df = pd.read_csv(code + '.csv', parse_dates=[1])

for i in days:

df['Gains after ' + str(i) + ' days'] = df['Close'].shift(-i)/df['Close'] - 1

df[pattern] = getattr(talib, pattern)(df['Open'].astype(float).values, df['High'].astype(float).values,

df['Low'].astype(float).values,df['Close'].astype(float).values)

pattern_df = df[df[pattern] != 0]

output = output.append(pattern_df)

try:

bullish_output = output[output[pattern]>0]

OneDayWinRate = len(bullish_output.loc[bullish_output['Gains after 1 days'] > 0]) /\

len(bullish_output['Gains after 1 days'])

FiveDaysWinRate = len(bullish_output.loc[bullish_output['Gains after 5 days'] > 0]) /\

len(bullish_output['Gains after 5 days'])

TenDaysWinRate = len(bullish_output.loc[bullish_output['Gains after 10 days'] > 0]) /\

len(bullish_output['Gains after 10 days'])

ThirtyDaysWinRate = len(bullish_output.loc[bullish_output['Gains after 30 days'] > 0]) /\

len(bullish_output['Gains after 30 days'])

final_output = final_output.append({'Pattern': 'Bullish ' + pattern,

'Win Rate (1 Day)': OneDayWinRate,

'Win Rate (5 Days)': FiveDaysWinRate,

'Win Rate (10 Days)': TenDaysWinRate,

'Win Rate (30 Days)': ThirtyDaysWinRate}, ignore_index=True)

except Exception as e:

print("No bullish pattern")

try:

bearish_output = output[output[pattern] < 0]

OneDayWinRate = len(bearish_output.loc[bearish_output['Gains after 1 days'] > 0]) / \

len(bearish_output['Gains after 1 days'])

FiveDaysWinRate = len(bearish_output.loc[bearish_output['Gains after 5 days'] > 0]) / \

len(bearish_output['Gains after 5 days'])

TenDaysWinRate = len(bearish_output.loc[bearish_output['Gains after 10 days'] > 0]) / \

len(bearish_output['Gains after 10 days'])

ThirtyDaysWinRate = len(bearish_output.loc[bearish_output['Gains after 30 days'] > 0]) / \

len(bearish_output['Gains after 30 days'])

final_output = final_output.append({'Pattern': 'Bearish ' + pattern,

'Win Rate (1 Day)': OneDayWinRate,

'Win Rate (5 Days)': FiveDaysWinRate,

'Win Rate (10 Days)': TenDaysWinRate,

'Win Rate (30 Days)': ThirtyDaysWinRate}, ignore_index=True)

except Exception as e:

print("No bearish pattern")

print('Done analysis on ' + pattern)

print(final_output)

final_output.to_csv('candlestick_analysis.csv',index=False)结果

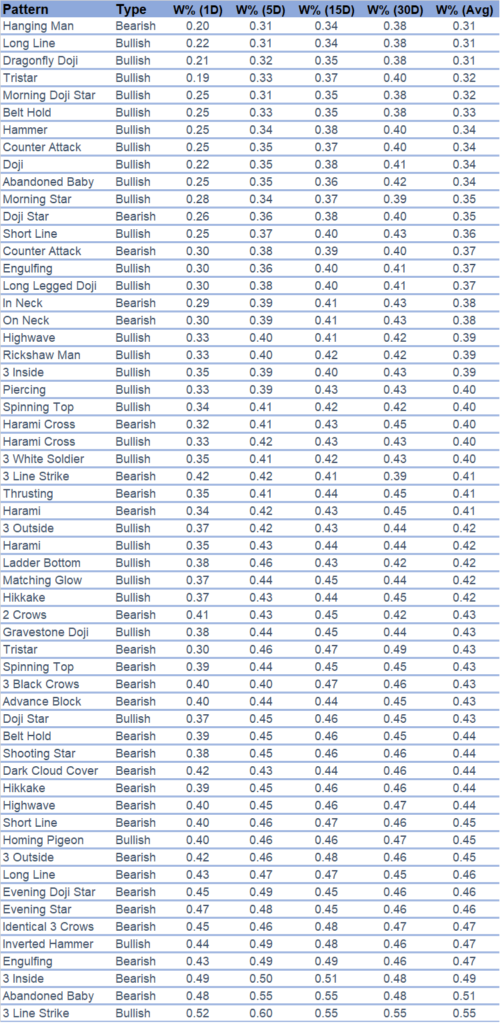

程序计算了每个蜡烛图形在马股每一个个股在 (1,5,10,30) 天过后的表现. 0.7的表现就等于在10次出现该蜡烛图形后, 有7次股价是上涨的.

小编整理了一些数据并列出所有的蜡烛图案

神奇的是, 许多牛市信号都有着非常低的赢率, 个人推断是因为当大家都使用同一个信号的时候, 其获利能力将会大大减少. 其实以上的结果是出乎我的意料的, 因为没想到竟然很少指标有超过50%的胜率. 可是值得一提的是有些蜡烛图形有超过0.45的胜率. 如果配合其他的指标和风险管理的话这可能是可以持续性获利的交易指标.

想法

这个回测程序也不是100%完美的, 一些弱点比如没有考虑蜡烛形态出现的地方 (有些形态是在低位/高位才比较有效的). 无论如何这次的研究也初步展示了蜡烛图形在马股的有效性和胜率.

或许蜡烛图形必须配合其他技术指标才能达到比较高的胜率. 值得一提的是, 0.2胜率的图形也可以当成反向指标来使用 (0.2的胜率代表图形出现后下跌的概率偏大)

这项研究的出发点是学习和探索用途. 交易自负