It’s a busy week, and I am running out of ideas to write about,

it’s a crazy month too,

- Worst opening of US equities market

- Correlation 1 moment happened, diversification didn’t save your ass

- 1 USD = 20 cents (UST)

Anyway, I am doing forex volatility prediction for my master’s degree project,

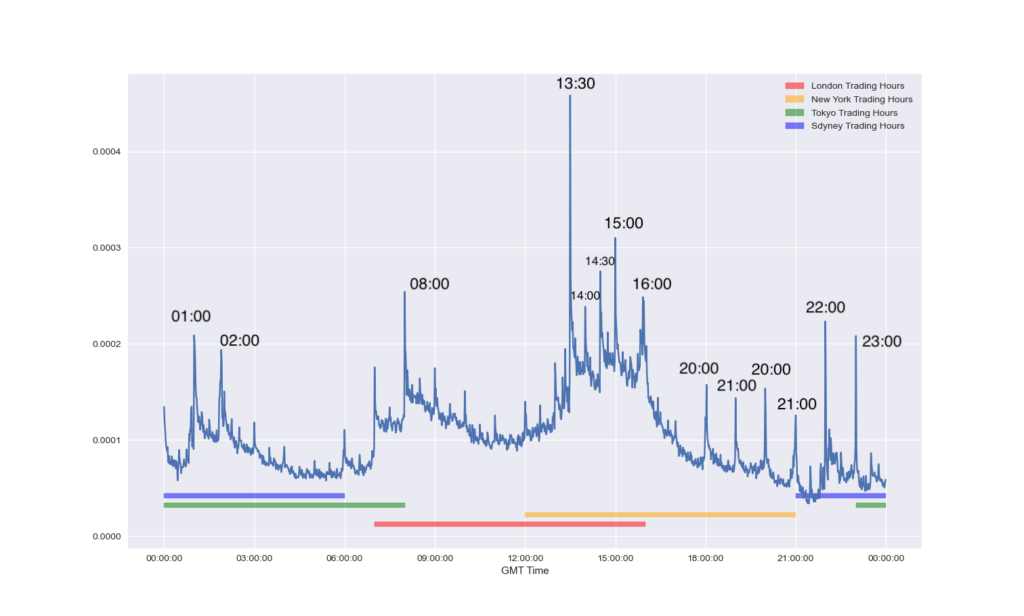

read some literatures out there, and discovered that there is actually a intra day volatility pattern for forex market.

A few points about that figure

- Forex trades 24 hours a day, 5 days a week. This is possible because we have a handful of exchanges globally, which they can takeover each other’s role when the other exchange closes for the day. And of course different exchanges have different trading volume, and hence different volatility as well. We can see that the volatility is highest during the overlap of London and New York trading hours.

- Volatility tend to spike during the beginning of the hour. This might be caused by the release of economic data, which usually happens during 00, 30 and 45th minute of the hour.

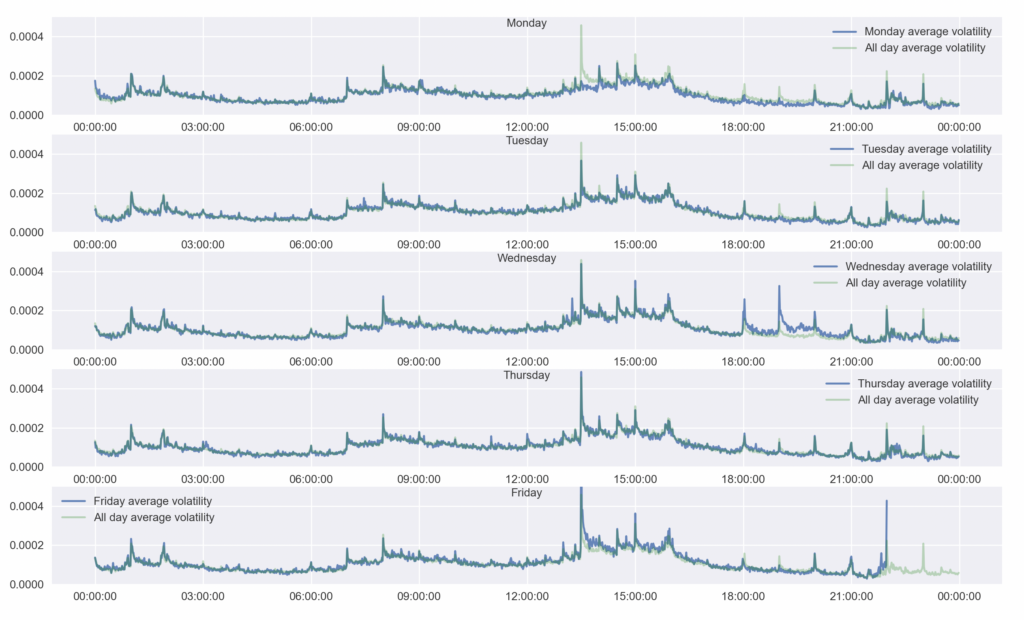

Other than that, volatility is lower when it’s Monday, seems like traders will also experience Monday Blue.

** I came up with these charts, I am happy if you want to use them, but please cite the source