均线策略

移动均线算是交易者们最常用的指标之一。

因为它在各大网站或图标软件都能见到它的踪影。

一个非常常用的策略就是金叉/死叉策略,

快线穿过慢线时买入,

快线跌破慢线时卖出。

这篇文章我们来探讨这个策略在马股KLSE指数的表现如何。

数据读取

我从Yahoo Finance上下载了KLSE指数的历史数据,

要分析数据得先读取这个csv文件。

import pandas as pd

KLSE = pd.read_csv('KLSE.csv')

KLSE = KLSE.replace(',','', regex=True)

KLSE['Open'] = KLSE['Open'].astype(float)

KLSE['Close'] = KLSE['Close'].astype(float)

KLSE['Change'] = (KLSE['Close'] - KLSE['Close'].shift(1))/KLSE['Open'] + 1

KLSE.head()| Date | Open | High | Low | Close | Adj Close | Volume | |

|---|---|---|---|---|---|---|---|

| 0 | 4-Jan-10 | 1272.31 | 1275.75 | 1272.25 | 1275.75 | 1275.75 | 56508200 |

| 1 | 5-Jan-10 | 1278.26 | 1290.55 | 1278.26 | 1288.24 | 1288.24 | 136646600 |

| 2 | 6-Jan-10 | 1288.86 | 1296.44 | 1288.02 | 1293.17 | 1293.17 | 117740300 |

| 3 | 7-Jan-10 | 1293.69 | 1299.70 | 1290.36 | 1291.42 | 1291.42 | 115024400 |

| 4 | 8-Jan-10 | 1294.93 | 1295.51 | 1290.86 | 1292.98 | 1292.98 | 74587200 |

策略规则

我们以最简单的双均线策略进行回测,

具体规则:

- 快线穿过慢线时买入

- 快线跌破慢线时卖出

- 不考虑交易成本

def simulate(df,fast,slow):

import talib

df['fast'] = talib.SMA(df['Close'],fast)

df['slow'] = talib.SMA(df['Close'],slow)

df.dropna(inplace = True)

gold_cross = df[df['fast'] > df['slow']].index

df.loc[gold_cross,'Cross'] = 1

gold_cross = df[df['fast'] < df['slow']].index

df.loc[gold_cross,'Cross'] = 0

df['Buy'] = df['Cross'].diff()

df['Return'] = df['Cross']*df['Change']

def norm(x):

if x == 0:

return 1

else:

return x

df['Return'] = df['Return'].apply(lambda x: norm(x))

df['Nav'] = (df['Return']).cumprod()

price_in = df.loc[df['Buy'] == 1,'Close'].values

price_out = df.loc[df['Buy'] == -1,'Close'].values

# divide by 252 because generally a year has 252 trading days

num_periods = df.shape[0]/252

rety = ((df['Nav'].iloc[-1] / df['Nav'].iloc[0]) ** (1 / (num_periods - 1)) - 1)*100.0

if len(price_out) > len(price_in):

price_out = price_out[:len(price_in)]

if len(price_in) > len(price_out):

price_in = price_in[:len(price_out)]

VictoryRatio = ((price_out - price_in)>0).mean()*100.0

DD = 1 - df['Nav']/df['Nav'].cummax()

MDD = max(DD)*100.0

return df, round(rety, 2), round(VictoryRatio, 2), round(MDD,2)策略表现

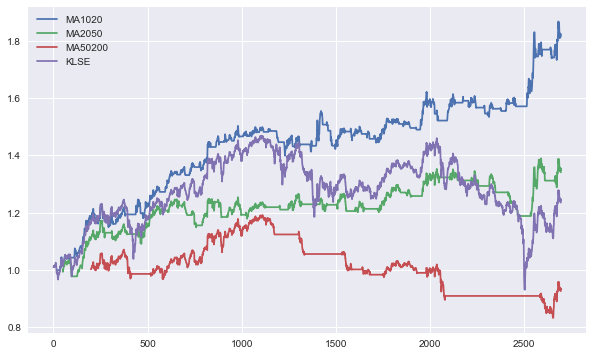

我们测试3对的均线,

毕竟每个人都会有自己喜欢的均线组合

- 10天线 和 20天线 (短期交易)

- 20天线 和 50天线 (中期交易)

- 50天线 和 200天线 (长期交易)

MA1020,cagr1020,vr1020,mdd1020 = simulate(KLSE.copy(),10,20)

MA2050,cagr2050,vr2050,mdd2050 = simulate(KLSE.copy(),20,50)

MA50200,cagr50200,vr50200,mdd50200 = simulate(KLSE.copy(),50,200)

KLSE['KLSE'] = (KLSE['Change']).cumprod()

import matplotlib.pyplot as plt

plt.style.use('seaborn')

ax = MA1020['Nav'].plot(figsize=(10, 6))

MA2050['Nav'].plot(ax=ax)

MA50200['Nav'].plot(ax=ax)

KLSE['KLSE'].plot(ax=ax)

# plt.plot( 'Date','Nav', data = MA2050, marker='', color='olive', linewidth=2)

ax.legend(['MA1020','MA2050','MA50200','KLSE']);

plt.show()

from prettytable import PrettyTable

t = PrettyTable(['Strategy', 'CAGR', 'Win Rate', 'Max Drawdown'])

t.add_row(['MA1020', cagr1020,vr1020,mdd1020])

t.add_row(['MA2050', cagr2050,vr2050,mdd2050])

t.add_row(['MA50200', cagr50200,vr50200,mdd50200])

print(t)

+----------+-------+----------+--------------+

| Strategy | CAGR | Win Rate | Max Drawdown |

+----------+-------+----------+--------------+

| MA1020 | 6.44 | 50.77 | 8.52 |

| MA2050 | 3.14 | 30.77 | 12.15 |

| MA50200 | -0.89 | 28.57 | 30.08 |

+----------+-------+----------+--------------+想法

从数据来看,看来短期的策略最适合KLSE指数

它的赢率也是最高的。

而且也大幅跑赢KLSE指数。

较长期的均线组合的表现较差强人意,

有些表现还不如直接买入持有。

这可能是因为KLSE指数的长期走势不强,

如果把这策略套用在长期走势强劲的指数(比如SP500),

相信成绩会好看得多。

想要自己测试的读者可以从Yahoo Finance下载想要的个股数据来分析看看。

纯属分享,无买卖建议