布林线

布林线算是个常见的技术指标,

它的背后的数学相当优美

先用平均线当中线,

再用标准差 (standard deviation) 来计算上轨线与下轨线。

有点像标准正态分布 (normal distribution)。

背后的数学这里就不解释了

网上多的很,加上也没几个人想看。

大家关心的还是这个策略到底可不可以赚钱,

这篇文章我们来探讨这个策略在马股KLSE指数的表现如何。

数据读取

我从Yahoo Finance上下载了KLSE指数的历史数据,

要分析数据得先读取这个csv文件。

import pandas as pd

KLSE = pd.read_csv('KLSE.csv')

KLSE = KLSE.replace(',','', regex=True)

KLSE['Open'] = KLSE['Open'].astype(float)

KLSE['Close'] = KLSE['Close'].astype(float)

KLSE['Change'] = (KLSE['Close'] - KLSE['Close'].shift(1))/KLSE['Open'] + 1

KLSE.head()| Date | Open | High | Low | Close | Adj Close | Volume | Change | |

|---|---|---|---|---|---|---|---|---|

| 0 | 4-Jan-10 | 1272.31 | 1275.75 | 1272.25 | 1275.75 | 1275.75 | 56508200 | NaN |

| 1 | 5-Jan-10 | 1278.26 | 1290.55 | 1278.26 | 1288.24 | 1288.24 | 136646600 | 1.009771 |

| 2 | 6-Jan-10 | 1288.86 | 1296.44 | 1288.02 | 1293.17 | 1293.17 | 117740300 | 1.003825 |

| 3 | 7-Jan-10 | 1293.69 | 1299.70 | 1290.36 | 1291.42 | 1291.42 | 115024400 | 0.998647 |

| 4 | 8-Jan-10 | 1294.93 | 1295.51 | 1290.86 | 1292.98 | 1292.98 | 74587200 | 1.001205 |

策略规则

这个策略的规则很简单,

要注意的是我们只Long,不Short,

毕竟在马来西亚卖空还是没那么容易的。

具体规则:

- 收市价升破上轨线时,买入

- 收市价跌破下轨线时,卖出Position

- 收市价在上轨线和下轨线之内波动,不做任何买卖

- 不考虑交易成本

def simulate(df,n):

import talib

df['UpperBand'], df['MiddleBand'],df['LowerBand'] = talib.BBANDS(df['Close'], timeperiod=n, nbdevup=2, nbdevdn=2, matype=0)

df.dropna(inplace = True)

gold_cross = df[df['Close'] > df['UpperBand']].index

df.loc[gold_cross,'Cross'] = 1

gold_cross = df[df['Close'] < df['LowerBand']].index

df.loc[gold_cross,'Cross'] = 0

df['Cross'].ffill(inplace=True)

df['Buy'] = df['Cross'].diff()

df['Return'] = df['Cross']*df['Change']

def norm(x):

if x == 0:

return 1

else:

return x

df['Return'] = df['Return'].apply(lambda x: norm(x))

df['Nav'] = (df['Return']).cumprod()

df.dropna(inplace=True)

price_in = df.loc[df['Buy'] == 1,'Close'].values

price_out = df.loc[df['Buy'] == -1,'Close'].values

# divide by 252 because generally a year has 252 trading days

num_periods = df.shape[0]/252

rety = ((df['Nav'].iloc[-1] / df['Nav'].iloc[0]) ** (1 / (num_periods - 1)) - 1)*100.0

if len(price_out) > len(price_in):

price_out = price_out[:len(price_in)]

if len(price_in) > len(price_out):

price_in = price_in[:len(price_out)]

VictoryRatio = ((price_out - price_in)>0).mean()*100.0

DD = 1 - df['Nav']/df['Nav'].cummax()

MDD = max(DD)*100.0

return df, round(rety, 2), round(VictoryRatio, 2), round(MDD,2)策略工作原理

这要解释也不容易,

还是上图吧!

绿箭头代表收市价升破上轨线,买入

红箭头代表收市价跌破下轨线,卖出 Position

Demo,_,_,_ = simulate(KLSE.copy(),20)

import matplotlib.pyplot as plt

plt.style.use('seaborn')

# Take a portion of the dataset to visualize,

# Otherwise the plot will be too small

Demo = Demo[500:1000]

ax = Demo['UpperBand'].plot(figsize=(10, 6),alpha=0.7)

Demo['Close'].plot(ax=ax,color='navy')

Demo['LowerBand'].plot(ax=ax,alpha=0.7)

# Buy signal

for p in Demo[Demo['Buy'] == 1].index:

ax.plot(p,Demo['Close'][p],marker='^',color='green',markersize=15)

# Sell signal

for p in Demo[Demo['Buy'] == -1].index:

ax.plot(p,Demo['Close'][p],marker='v',color='red',markersize=15)

plt.show()

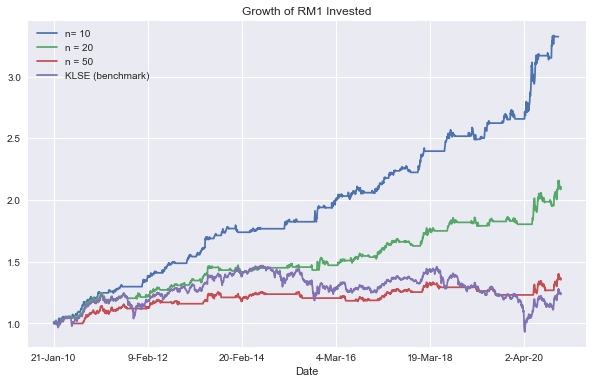

策略表现

我们测试3个设置,

分别是

- 10天 (短期交易)

- 20天 (中期交易)

- 50天 (长期交易)

BBandShort,cagrShort,vrShort,mddShort = simulate(KLSE.copy(),10)

BBandMed,cagrMed,vrMed,mddMed = simulate(KLSE.copy(),20)

BBandLong,cagrLong,vrLong,mddLong = simulate(KLSE.copy(),50)

KLSE['KLSE'] = (KLSE['Change']).cumprod()

ax = BBandShort.plot(x='Date',y='Nav',figsize=(10, 6))

BBandMed['Nav'].plot(ax=ax)

BBandLong['Nav'].plot(ax=ax)

KLSE['KLSE'].plot(ax=ax)

ax.legend(['n= 10','n = 20','n = 50','KLSE (benchmark)']);

ax.set_title('Growth of RM1 Invested')

plt.show()

from prettytable import PrettyTable

t = PrettyTable(['Strategy', 'CAGR', 'Win Rate', 'Max Drawdown'])

t.add_row(['布林线 (10)', cagrShort,vrShort,mddShort])

t.add_row(['布林线 (20)', cagrMed,vrMed,mddMed])

t.add_row(['布林线 (50)', cagrLong,vrLong,mddLong])

print(t)

+-------------+-------+----------+--------------+

| Strategy | CAGR | Win Rate | Max Drawdown |

+-------------+-------+----------+--------------+

| 布林线 (10) | 13.19 | 50.0 | 5.57 |

| 布林线 (20) | 7.94 | 46.88 | 5.57 |

| 布林线 (50) | 3.3 | 35.71 | 7.91 |

+-------------+-------+----------+--------------+结论

从数据来看,胜率有点低,最高也只是50%

可是它看起来可以让交易者避免大规模下跌,参与升势。

而且大部分也都跑赢KLSE指数。

较长期的设置的表现较差强人意,

看起来布林线应该适合短期交易而已。

想要自己测试的读者可以从Yahoo Finance下载想要的个股数据来分析看看。

纯属分享,无买卖建议